Types of GST, What is SGST, CGST & IGST?

- PUBLISHED : 13-02-2019 00:00:00

Goods and Services Tax (GST) is single comprehensive tax applicable for the entire nation. It has replaced a number of indirect taxes in India, including central excise duty, state VAT, additional duties of customs and entertainment tax. Two of its characteristic features are:

- It is added at every step of value addition along the supply chain. Thus, it is multistage in nature. However the cascading effect of tax is prevented by the implementation of input tax credit.

- It depends on the destination of consumption. For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is accredited to the state of consumption (state B) and not to the state of production (state A). To compensate for the possible losses to the manufacturing-heavy states, GST compensation cess is levied.

- SGST/UTGST: It is collected by the individual states and union territories when the supply occurs within the same state/union territory. For example, when a good is both manufactured and sold within Gujarat, SGST will be levied by the Gujarat state.

- CGST: It is collected by the Central government in case of an intra-state transaction i.e. transaction within the same state. In the above example, CGST will be levied, in addition to SGST, by the Central government.

- IGST: IGST or Integrated GST is levied by the Central government when the location of the supplier of a good/service and the place of consumption lie in different states. The IGST so collected is subsequently divided between the State and Centre.

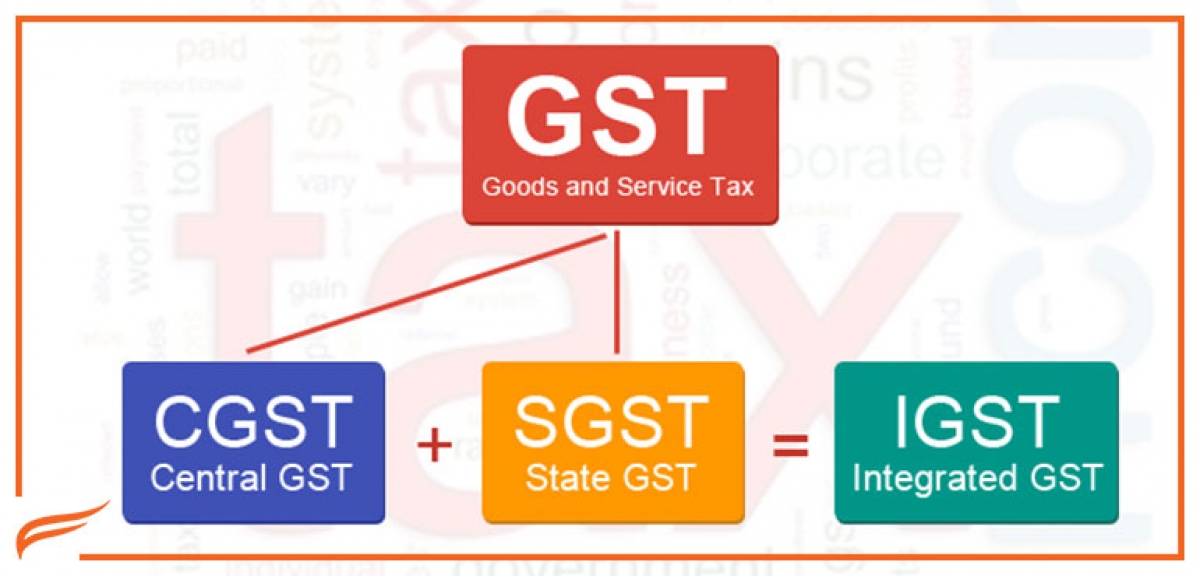

Components of GST

There are three components of GST, namely SGST, CGST and IGST.

How to know when SGST, CGST or IGST is applicable?

The locations of the supplier of the goods/ services and that of the consumer determine whether a combination of SGST and CGST will be applicable or only IGST.

Intra-state Transactions

For a transaction completed within the state, both SGST and CGST are levied at the time of collection. For example, if 1 tonne of coal worth Rs. 5000 is supplied by a supplier in Gujarat to a consumer in the same state, total 5% of GST will be collected by the supplier from the consumer. This 5% GST will constitute 2.5% SGST and 2.5% CGST, and will be directly diverted to the state and the centre.

Inter-state Transactions

For a transaction completed between 2 states, IGST is applicable. For example, if the coal supplier in Gujarat had sold the coal worth Rs. 5000 to a consumer in Maharashtra, IGST at the rate of 5% would have been collected. The IGST collected by the Centre is later divided between the State of consumption (i.e. Maharashtra in our example) and the Central Government.

Hence, for intra-state transactions, both SGST and CGST are levied. While for inter-state transactions only IGST is collected, which is later divided between the state and the centre. Notably, this does not create any difference for the consumer as the combined rate of SGST and CGST is always equal to the IGST rate. This system ensures smooth flow of taxes between the state and the centre without complicating the tax rates for the seller or the consumer.

SGST, CGST and IGST rates of some common items

|

Goods |

SGST |

CGST |

IGST |

|

Household necessities like tea, coffee (except instant), edible oil, spices, and sugar. Coal, life-saving drugs and Indian Sweets are also covered under this GST slab. |

2.5% |

2.5% |

5% |

|

Processed food and computers |

6% |

6% |

12% |

|

Hair oil, soaps and toothpaste, capital goods and industrial intermediaries. |

9% |

9% |

18% |

|

Luxury items, including premium cars consumer durables like AC and refrigerators, cigarettes, aerated drinks, and high-end motorcycles |

14% |

14% |

28% |

About Us

Hope you enjoyed reading this article. At Falcon eBiz, we continuously work to empower Indian businesses. If you own a business, you can try our super-simple accounting software.

With this software you can create GST bills, track inventory, manage expenses, and even file GST returns. It’s very easy to use and doesn’t require any accounting knowledge.

Know more about our GST ready Accounting software

Know more abour our GST Services

Also Read - GST Rates 2020-21 – Complete List of Goods and Services Tax Slabs